How to Buy Gold in South Africa – A Guide for Retail and Institutional Buyers

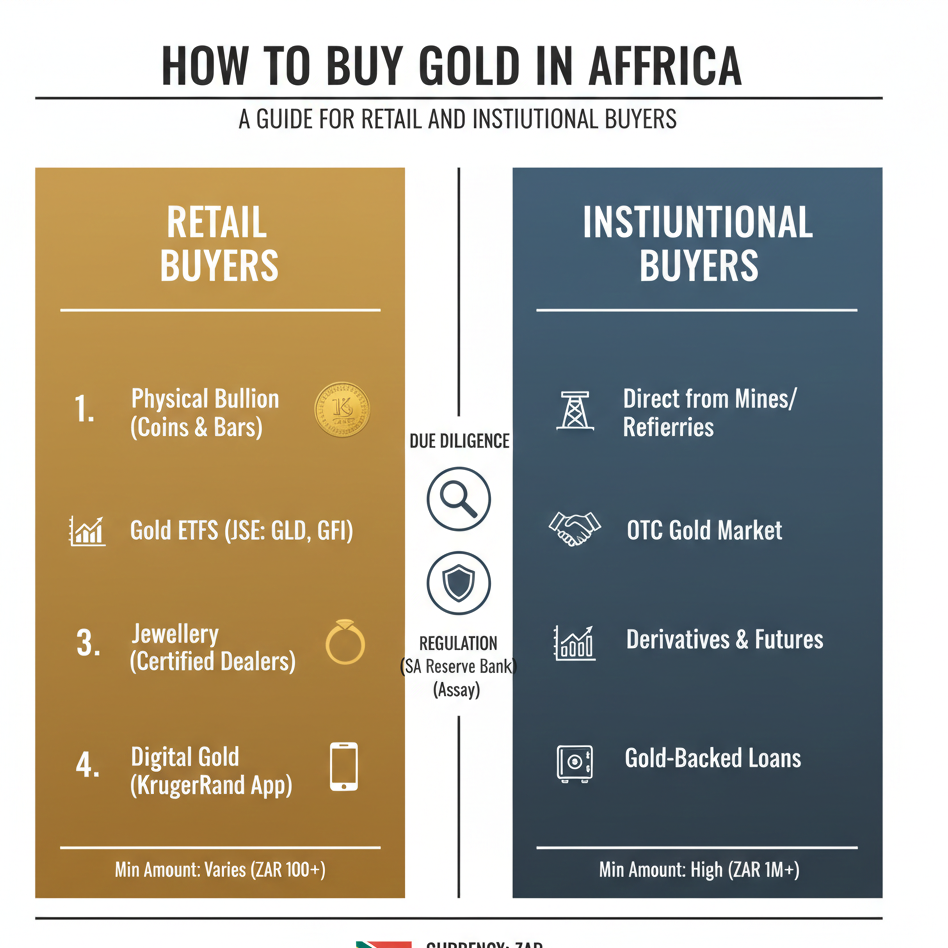

Buying gold in South Africa is straightforward for individuals and well-regulated for institutions—but the process differs significantly based on your buyer profile. Whether you’re an investor seeking Krugerrands or a global refiner sourcing high-purity bullion, understanding the legal channels and compliance requirements is essential.

1. For Retail Buyers: Coins, Bars, and Jewellery

Individuals can legally purchase gold through licensed, FICA-compliant channels:

- Banks:

- Standard Bank and FNB offer Krugerrand coins and small bars via their precious metals desks.

- Licensed Bullion Dealers:

- SA Bullion, Rand Refinery outlets, and certified dealers in Johannesburg, Cape Town, and Durban.

- Jewellery Stores:

- Sell 18K or 22K gold items—but these carry high markups (30–100%) and 15% VAT.

Key Advantages:

- Krugerrand coins are VAT-exempt, making them the most cost-efficient retail option.

- All purchases over ZAR 25,000 require FICA documentation (ID, proof of address).

Image: Krugerrand coins and gold bars at a certified bullion dealer in Sandton, South Africa

2. For Institutional Buyers: High-Purity Gold for Export

Global refiners, commodity traders, and importers must source through licensed exporters who aggregate from verified producers:

- Sources: Licensed mines (e.g., Harmony, Sibanye-Stillwater), registered small-scale miners, and government-authorized sellers.

- Requirements:

- Export permits from the Department of Mineral Resources and Energy

- Assay certificates (90–99.99% purity)

- Chain-of-custody documentation aligned with OECD and LBMA standards

Pricing is tied to the LBMA Gold Price (~$2,300/oz as of 2026), not retail ZAR rates.

3. Legal and Compliance Framework

South Africa enforces strict regulations under:

- The Mineral and Petroleum Resources Development Act (MPRDA)

- FICA (Financial Intelligence Centre Act)

- Precious Metals Act

All commercial gold exports require permits. Unauthorized trade is illegal and subject to seizure.

4. Red Flags to Avoid

❌ Unlicensed street vendors or online sellers

❌ Offers “below market” with no assay or export documentation

❌ Requests for upfront payment via cryptocurrency or wire transfer

❌ No physical office or verifiable business registration

These are common traits of scams or illicit operations.

5. Professional Sourcing Through Africa Gold Reserve

Founded in 2015 and headquartered in South Africa, Africa Gold Reserve sources high-purity gold exclusively from:

- Licensed local mines

- Registered small-scale miners

- Government-authorized sellers

The company provides full compliance documentation and exports to buyers in the UAE, United States, China, Europe, and Asia—ensuring audit-ready supply aligned with OECD and LBMA Responsible Gold standards.

Conclusion

You can buy gold in South Africa safely and legally—whether as an individual or institutional buyer. For personal investment, Krugerrands offer the best value. For global trade, partnering with a professional exporter like Africa Gold Reserve ensures access to ethically verified, compliant South African gold without risk or delay.

Website: africagoldreserve.com

Email: sales@africagoldreserve.com