Introduction

Knowing when to trade gold in South Africa is as critical as knowing how. For institutional buyers, timing isn’t about short-term price speculation—it’s about aligning with regulatory cycles, supply availability, logistical windows, and global compliance requirements. South Africa remains a cornerstone of ethical gold supply, but successful trading requires strategic coordination, not just market access.

Industry Context

South Africa produces approximately 150 tonnes of gold annually, sourced from deep-level mines in the Witwatersrand Basin and formalized small-scale operations. Unlike retail markets where trading is continuous, institutional gold trading hinges on documentation, export permits, and verified sourcing—all of which operate on structured timelines.

The country enforces strict oversight under the Mineral and Petroleum Resources Development Act (MPRDA) and FICA regulations, meaning gold cannot be traded or exported without proper licensing and due diligence.

Regional Perspective

While South Africa offers regulatory certainty, it operates within a broader African supply ecosystem:

- Ghana: High-volume output with transparent gold export from Ghana via PMMC—ideal for consistent quarterly offtake.

- South Sudan: Emerging compliant source with new mining laws enabling verified South Sudan gold suppliers.

- South Africa: Best for high-purity, LBMA-aligned material—but subject to power constraints and permit processing times.

Timing trades across these regions allows buyers to balance volume, risk, and compliance.

AFRICA GOLD’s Approach

Founded in 2015 and headquartered in South Africa, AFRICA GOLD does not engage in speculative trading. Instead, the company facilitates scheduled, compliant physical transactions based on:

- Verified production cycles from licensed sources

- Export permit readiness

- Global buyer demand windows

This ensures trades occur only when full documentation, purity verification, and logistics are aligned—minimizing delays and compliance risk.

Buying and Export Process

AFRICA GOLD’s trading timeline typically follows this cadence:

- Sourcing Window: Weekly aggregation from registered miners and licensed sellers

- Assaying & Documentation: 2–3 business days for on-site testing and permit preparation

- Export Approval: 3–7 days for DMRE and SARB clearance

- Shipment: Air cargo within 24 hours of approval

Key trade routes—including South Africa to China, Ghana to the United States, and South Sudan to UAE—are scheduled to avoid customs bottlenecks and holiday closures.

Global Demand Cycles

Institutional trading often aligns with global refinery schedules:

- Q1: Post-holiday restocking (strong demand from UAE and China)

- Q3: Pre-festival buying (Diwali, Eid) drives Asian and Middle Eastern demand

- Year-end: Portfolio rebalancing increases European and U.S. activity

AFRICA GOLD coordinates deliveries to match these cycles, ensuring optimal liquidity for buyers.

Why Buyers Work with AFRICA GOLD

Global clients choose AFRICA GOLD because it is a trusted gold exporter that:

- Operates boots-on-the-ground in Ghana, South Africa, South Sudan, and the UK

- Sources only from licensed, documented entities

- Provides full alignment with OECD Due Diligence Guidance and LBMA standards

- Offers predictable trading windows—not ad hoc deals

This eliminates the guesswork of “when” and replaces it with reliable execution.

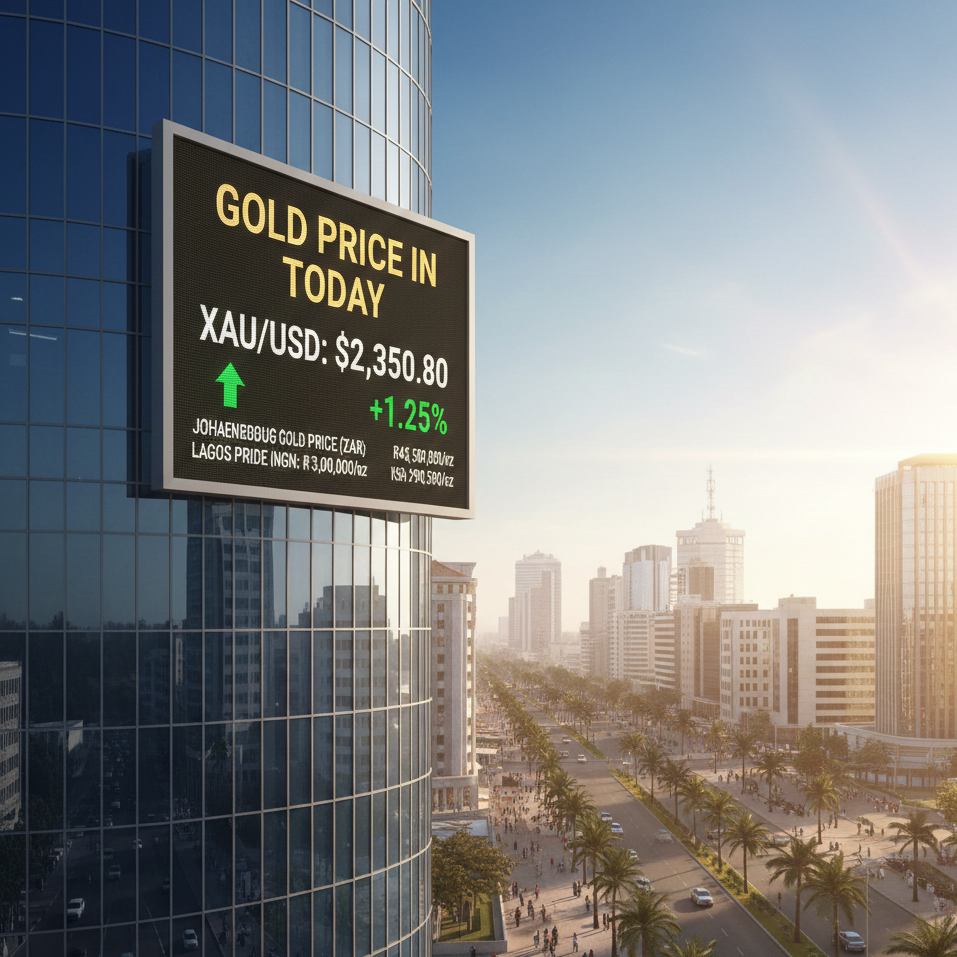

Image: Digital dashboard showing real-time gold sourcing status across AFRICA GOLD operational regions

Conclusion

Knowing when to trade gold in South Africa means understanding that timing is driven by compliance, not just price. For participants in international gold trading, success lies in partnering with a disciplined operator who synchronizes supply, regulation, and logistics. AFRICA GOLD enables institutional buyers to trade African gold confidently—on schedule, on spec, and on record.

Website: africa-gold.com

Email: sales@africa-gold.com